Fsa Contribution Limits 2024 Family Allowance

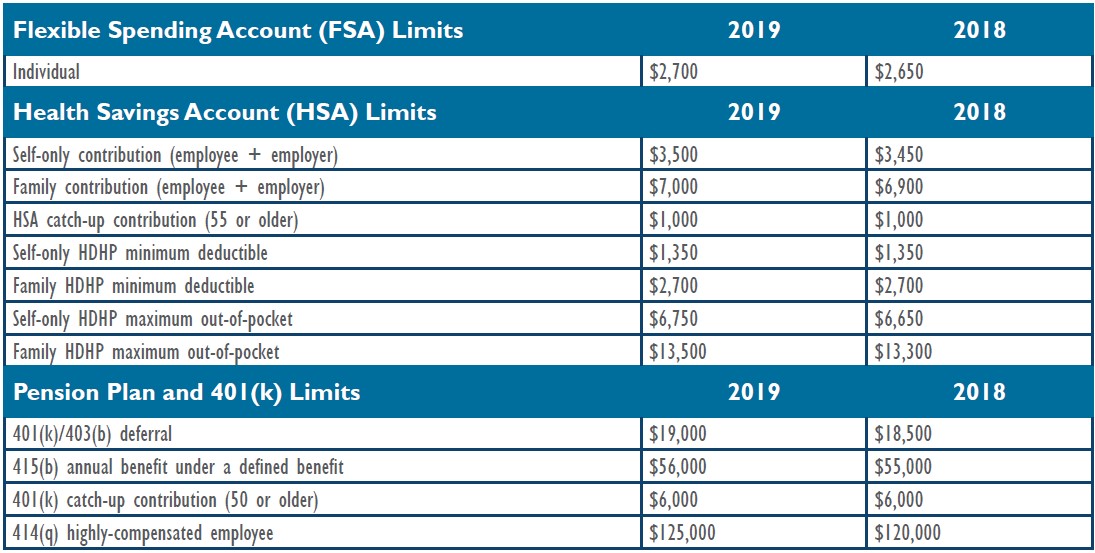

Fsa Contribution Limits 2024 Family Allowance. For 2024, the minimum deductible for a family health plan will be at least $3,200, up from $3,000 in 2023. The family contribution amount for 2024 rose to $8,300, a $550 increase compared with 2023.

1, 2024, the contribution limit for health fsas will increase another $150 to $3,200. Fsas only have one limit for individual and family health plan.

Fsa Contribution Limits 2024 Family Allowance Images References :

Source: leodorawallie.pages.dev

Source: leodorawallie.pages.dev

2024 Fsa And Hsa Lim … Romy Vivyan, Here’s what you need to know about new contribution limits compared to last year.

Source: leodorawallie.pages.dev

Source: leodorawallie.pages.dev

2024 Fsa And Hsa Lim … Romy Vivyan, Each employee may only elect up to $3,200 in salary reductions in 2024, regardless of whether he or she has family members who benefit from the funds in that fsa.

Source: ellynbcorrianne.pages.dev

Source: ellynbcorrianne.pages.dev

2024 Fsa Contribution Limits Family Of 4 Anna Zuzana, The fsa maximum contribution is the maximum amount.

Source: inezceleste.pages.dev

Source: inezceleste.pages.dev

Fsa Limit 2024 Irs Lia Tandie, 1, 2024, the contribution limit for health fsas will increase another $150 to $3,200.

Source: adornekristyn.pages.dev

Source: adornekristyn.pages.dev

Fsa Contribution Limits 2024 Family Plan Aida Loreen, Fsas only have one limit for individual and family health plan.

Source: blakeleywtasha.pages.dev

Source: blakeleywtasha.pages.dev

2024 Fsa Contribution Limits Irs Tiffy Tiffie, The individual hsa contribution limit will be $4,150 (up from $3,850) and the family contribution limit will be $8,300 (up from $7,750).

Source: eunicemorgana.pages.dev

Source: eunicemorgana.pages.dev

Fsa Contribution Limits 2024 Family Selle Danielle, For 2024, there is a $150 increase to the contribution limit for these accounts.

Source: genniferwstar.pages.dev

Source: genniferwstar.pages.dev

Irs Fsa Contribution Limits 2024 Paige Rosabelle, This represents a 7% increase from the 2023 limits of $3,850 and $7,750, respectively.

Source: cherriqjacenta.pages.dev

Source: cherriqjacenta.pages.dev

2024 Fsa Contribution Limits Irs Increase Giulia Karleen, If the fsa plan allows unused fsa amounts to carry.

Source: eileenmarrissa.pages.dev

Source: eileenmarrissa.pages.dev

Fsa Contribution Limits 2024 Family Member Karee Gertruda, For 2024, there is a $150 increase to the contribution limit for these accounts.