What Is Standard Tax Deduction For 2024 Taxes

What Is Standard Tax Deduction For 2024 Taxes

These amounts are provided in the chart below. The irs adjusts the standard deduction.

The standard deduction in 2024 is $14,600 for individuals, $29,200 for joint filers, and $21,900 for heads of households. The standard deduction is increasing by more than 5% for 2024 income tax returns, which will be filed in 2025.

You Can Claim A Standard Deduction To Reduce Your Taxable Income As Well As An Additional Deduction If You Are Age 65 Or Older And/Or Blind.

The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an increase of $750 from 2023.

The Standard Deduction Is Increasing By More Than 5% For 2024 Income Tax Returns, Which Will Be Filed In 2025.

For 2024 (tax returns typically filed in april 2025), the standard deduction amounts are $14,600 for single and for those who are married, filing separately;

Images References :

Source: imagetou.com

Source: imagetou.com

Taxes Standard Deductions 2024 Image to u, Most of the tax relief provisions in this new law are retroactively effective as of january 1, 2024, including provisions to reduce individual income tax rates; Standard deduction is a fixed amount that taxpayers can deduct from their taxable income without the need for receipts or expense proofs.

Source: bibbyqeugenia.pages.dev

Source: bibbyqeugenia.pages.dev

2024 Standard Tax Deduction Ettie, If an employee does not opt for the old tax regime initially,. Most of the tax relief provisions in this new law are retroactively effective as of january 1, 2024, including provisions to reduce individual income tax rates;

Source: karaleewlivia.pages.dev

Source: karaleewlivia.pages.dev

2024 Standard Deductions And Tax Brackets Debi Carlene, Taxpayers who are 65 and older, or are blind, are eligible for an additional. The standard deduction in 2024 is $14,600 for individuals, $29,200 for joint filers, and $21,900 for heads of households.

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

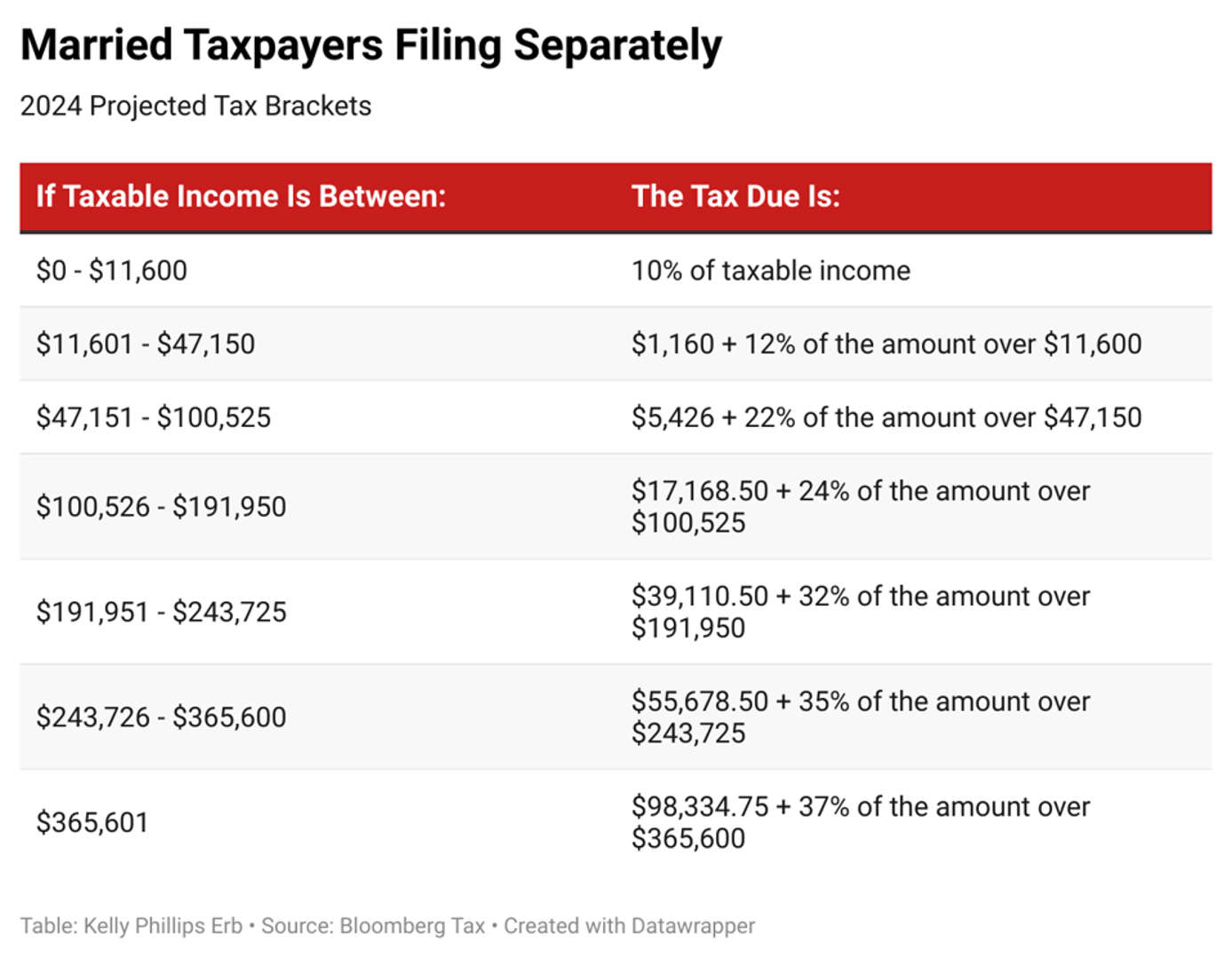

Irs New Tax Brackets 2024 Elene Hedvige, In 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million (twice that for couples making joint gifts). The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an increase of $750 from 2023.

Source: bettyeqnoelyn.pages.dev

Source: bettyeqnoelyn.pages.dev

2024 Itemized Deductions Form Becka Klarika, If you earned $75,000 in 2023 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to $61,150. The 2024 standard deduction is $14,600 for single filers, $29,200 for joint filers and $21,900 for heads of household.

Source: eleniqleticia.pages.dev

Source: eleniqleticia.pages.dev

2024 Tax Brackets Vs 2024 Taxes Korie Thelma, In 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million (twice that for couples making joint gifts). The change is one of several annual adjustments.

Source: angyqkaterina.pages.dev

Source: angyqkaterina.pages.dev

2024 Tax Brackets Irs Chart Ruthi Tarrah, The change is one of several annual adjustments. The standard deduction is a fixed amount employed individuals can subtract from their taxable salary income without providing evidence of actual expenses.

Source: gretnaqcherice.pages.dev

Source: gretnaqcherice.pages.dev

California Standard Deduction For 2024 Jojo Lexine, Standard deduction is a fixed amount that taxpayers can deduct from their taxable income without the need for receipts or expense proofs. The standard deduction is a fixed dollar amount that reduces the amount of income you get taxed on.

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know, The change is one of several annual adjustments. For 2024 (tax returns typically filed in april 2025), the standard deduction amounts are $14,600 for single and for those who are married, filing separately;

Source: kmmcpas.com

Source: kmmcpas.com

Your first look at 2024 tax rates, brackets, deductions, more KM&M CPAs, People 65 or older may be eligible for a higher amount. For the 2023 tax year, which is filed in early 2024, the federal standard deduction for single filers and married folks filing separately was $14,600.

Taxpayers Who Are 65 And Older, Or Are Blind, Are Eligible For An Additional.

For 2024, the baseline amount for those claimed as a dependent, increases to $1,300 and the standard deduction increase to $14,600 for those filing as single.

Here Are The Standard Deduction Amounts For The 2023 Tax Returns That Will Be Filed In 2024.

You can claim a standard deduction to reduce your taxable income as well as an additional deduction if you are age 65 or older and/or blind.